Eloy Fernández Deep Research is holding Leatt Corporation and updating regularly. Follow his updates. There is also many other posts and interviews on Leatt. Most from period before the revenues dropped last quarter of 2022.

2022 FINANCIALS

Income Statement

After the big spike in revenue during Covid Leatt saw a much lower 4th quarter of 2022. Q1 2023 further emphasized this with much lower revenues compared to Q1 2022, but a 20% QoQ growth from Q4. After this “normalization” we can expect 2023 to be considerably lower in total revenues than 2021-2022. Perhaps around 60-65 mill if their QoQ growth continues. Keep an eye coming quarters. Growth QoQ should ideally be around 15%.

Now let’s have a look at their annual results over the past three years.

Leatt are most known for and holds potents on their neck braces. The neck braces will remain for the most serious riders and the sales will depend on the overall growth of the sports (moto, enduro, etc). The market for the neck braces should be smaller than the other product lines but it has been crucial is giving Leatt their good reputation.

The major revenue driver over the past three years is their body armor. The body armour, even though still for the more serious athletes, are used by a wider range of sports/activities and athletes.

The helmets are the fastest growing product line and potentially the biggest growth potential too. They could move into more casual and recreational markets here. They also have the patented 360° Turbine Technology which means they are not using MIPS which most of their competitors use.

Other products consist of a wide range of products from casual wear to accessories and parts. Especially “technical apparel design for off-road motorcycle and mountain biking shoes” was primary drivers here.

From what I understand from the above Dealer Direct Revenues are the distribution networks controlled by Leatt directly (in the US and South Africa), while the International Distributor Revenues are 3rd party distributors across the world. Consumer Direct Revenues are sold directly of their webpage - www.leatt.com.

I could be wrong on the above, and this should be looked into further.

The boosts in interest during the covid years caused there to be a high demand from dealers. When the demand suddenly plummeted somewhat in later parts of 2022 the dealers was sitting with elevated stock levels that needs to be cleared. This could again exaggerate the revenue decreases in Q4 2022 and Q1 2023. Hopefully the remaining parts of 2023 will increase and stabilize revenues at a higher level than currently.

There was no exact reporting on geographical revenue distribution for FY2022, but it was mentioned that international revenues accounted for 77%.

The Gross Profit Margins reduced from 43% to 41% from 2021 to 2022. The reason for the margin drop is likely related to more sales happening via the international distribution network and not via the Leatt-controlled network.

The margin should stay above 40% moving forward. If it falls below that there should be reason for concern and a closer look.

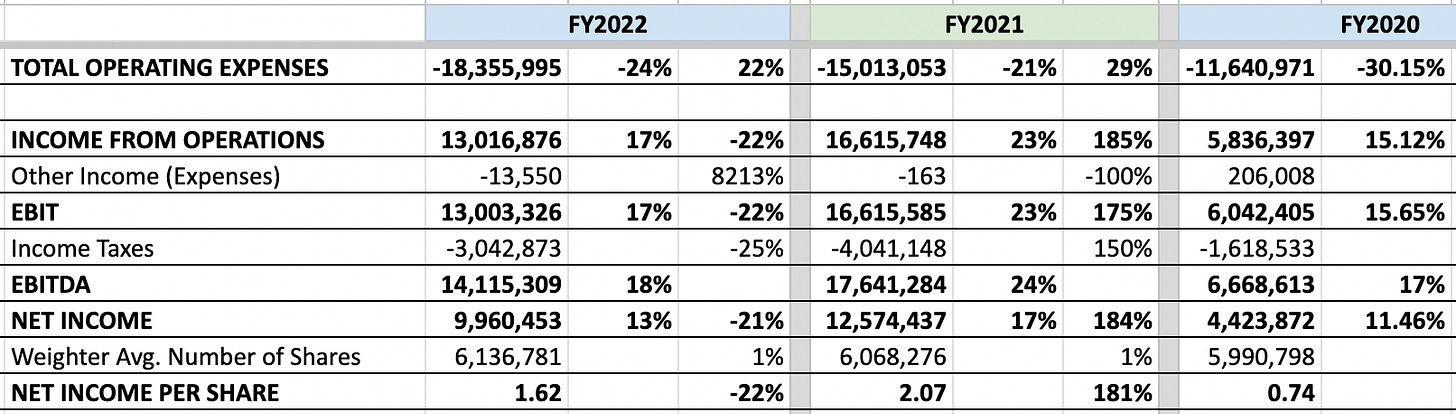

Operating expenses grow 22% YoY. Biggest contributors to the increase were Salaries, Marketing and G&A. Neither of these is causing me any major concerns for the time being.

The Operating Margins dropped to 17%. I am expecting the op. margin to increase in 2023 and onwards as the market should stabilize a bit more after the big Covid-bump mentioned earlier.

All above resulted in a 22% decrease in EBIT and Net Income Per Share.

Balance Statement

92% of their total Assets are current assets, with the majority being cash (14%), receivables (25%) and inventory (44%). I do not know how much inventory a company like Leatt should be holding, but I assume that they too overestimated the market and has been stuck with elevated inventory levels now.

Inventory management is important for a company like Leatt, and should be kept an eye on. Poor inventory management and high levels of receivables has a big effect cash flow. As we saw in the Income Statement the net income was 10 mill, EBITDA was 14 mill, but cash at hand only increased by 2 mill. This is a reason for concern that should be followed closely.

Current liabilities amount to 92% of all liabilities with the big ones being account payables (49%) and tax payable (28%). There has been a big decrease in Account Payables from 2021 with around 8.6 mill paid - 59% reduction. This should explain how cash in the asset section has only increased by 2 mill.

Cash Flow Statement

Things to take note of from the Cash Flow Statement is:

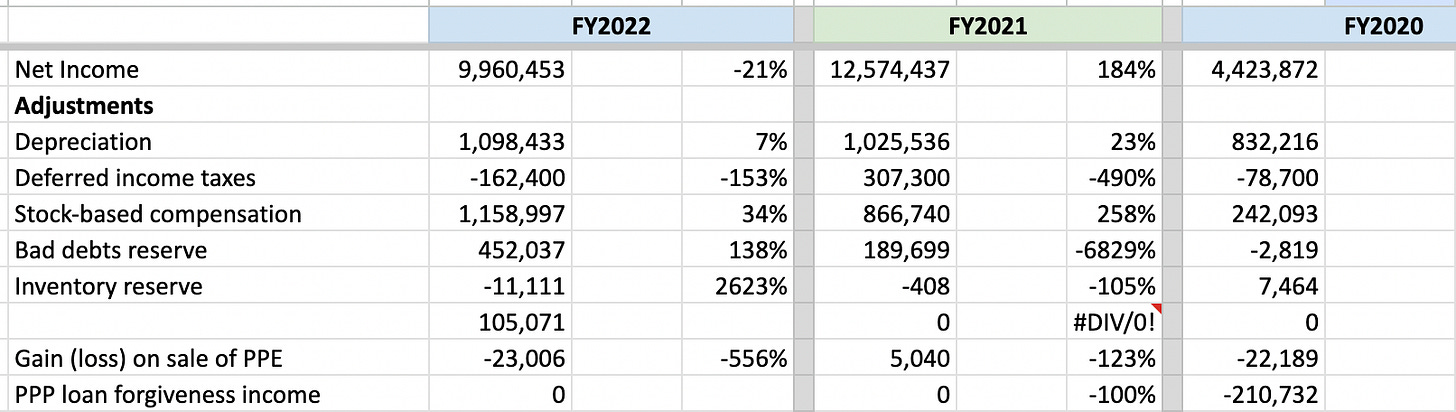

Stock based compensation has been increasing.

Changes in inventory, account receivables and account payables.

Leatt has stated that they had increased their stock-based compensation to let their employees benefit from their growth during the covid years. At first glance and considering that the free cash flow generated over the past couple of years is relatively low this does seem high and should be kept an eye one. That being said it should look better when (if) free cash flow improves.

Leatt made huge investments in their inventory in 2021 bumping it up by 11 mill. On top of this there was almost 8 mill increase in receivables + prepaid expenses. This was partly offset by an increase of almost 7 mill in payables, but this strongly reduce their Free Cash Flow in 2021.

In 2022 their increase increased in inventory and receivables were much less, but Leatt used 8.6 mill to pay down on account payables. This again strongly reduced their Free Cash Flow in 2022.

In 2023 they should receive considerably more in receivables than they pay in payables, and inventory is already elevated and should not increase that much. So one should expect a strong Free Cash Flow this year. Q1-23 also seemed to emphasize this with a cash flow per share much higher than before.

CAPEX has been stable and coming down over the past years.

Free Cash Flow is only 1.9 mill compared to 14 mill EBITDA. A poor conversion rate that needs to improve over time. Nothing more needs adding here.

Ratios & Margins

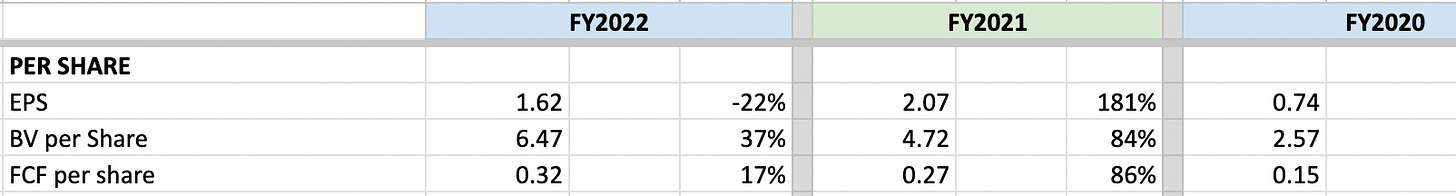

Gross Margins (and concequently others) have been coming down caused by more sales going through international distributors + increases in lower margin sales such as “Other products” but should stay over 40%.

The FCF Margin should be much better in 2023, but beyond that it will depend on their handling of inventory and payables/receivables. Should stabilize at a higher rate.

Return ratios and debt levels looking good.

Earnings, book value and free cash flow per share should increase in 2023. Especially FCF should be much improved this year.

Summary

What to keep an eye on during 2023:

Revenue around 60-65 mill with gross margins above 40%.

Inventory management and changes in receivables and payables.

Free Cash Flow should be much better in 2023 than previous years.

What I need to learn:

Inventory management for this type of business.

Will FCF always be lower?

Thats it for this note.